Budgeting Vs Monetary Forecasting: What Is The Difference?

Project future earnings by contemplating client demand, market tendencies, and financial circumstances. It impacts the taxes you pay, the funding and quality https://www.simple-accounting.org/ of public providers (healthcare, education), and overall economic stability. If new merchandise are on the finest way, talk to the team developing them. Get some concept of the release dates and confirm they’re on monitor to satisfy them. Discuss to your advertising director about promotions and what you’ll find a way to anticipate. Hopefully, your finances has given you a way of where your money goes.

Typically, a authorities is forced to spend more than it collects. For example, nations with low income collections need extra infrastructure, industrial growth, and residing circumstances. In contrast, a high-revenue nation is considered ideal—high consumption ranges. As a end result, proposed budgets are often rejected, however funds are disbursed only when permitted. Based Mostly on the income expenditure knowledge, the government makes selections about funding (where to spend money). Primarily, a authorities allocates funds towards new tasks, infrastructure, welfare, amenities, and the providers sector.

The whole of the income price range is then in comparison with the annual expense finances. Most budgeted income comes from gross sales of one thing, whether or not it is items or providers. There’s no budgeted sales method into which you will find a way to plug numbers to get a solution. It takes information of your organization and your market in addition to logic. A revenue budget is a projection of your company’s earnings over the approaching 12 months, ideally broken down month by month. The end result on which you settle is your budgeted income for the yr.

Budgeting Vs Financial Forecasting: An Outline

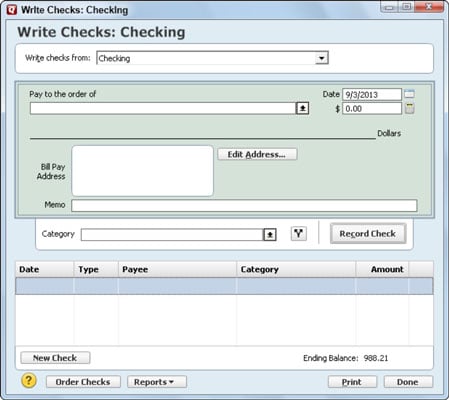

Those ultra-high interest rates in your bank cards aren’t fastened in stone. Call the cardboard company and ask for a reduction in the annual percentage rates (APR). If you’ve a great payment document, your request could be accredited. This will not decrease your outstanding steadiness, however it’s going to keep it from mushrooming as fast. Stashing 10% of your income into your savings account is daunting or unimaginable whenever you’re residing paycheck to paycheck. It does not make sense to have $100 in a financial savings plan if you’re keeping off debt collectors.

Cash Foundation Of Accounting

Folks can generally cut too many bills so that they end up with a budget that they can not stick with. Substitution, in contrast, retains the fundamentals whereas trimming costs. Evaluate your bottom-up sales model totals against the top-down income targets set earlier. Ensure your detailed projections align with your general targets.

Typically, governments spend more than it earns—the distinction is unfavorable and known as the income deficit. Cash accounting records funds and receipts when they are acquired. Accrual data funds and receipts when services or good are supplied or debt is incurred. On top of that, these prices differ throughout different durations based mostly on the underlying needs.

- Accrual accounting differs from money foundation accounting, the place expenses are recorded when cost is made and revenues are recorded when cash is received.

- Simply know that you just’re not the one person setting smart financial limits for your self.

- Mostly via taxes (like earnings and sales taxes) and likewise from non-tax sources similar to interest earnings or charges for services.

- Accrual accounting supplies a extra accurate image of a company’s monetary position.

- Individuals can typically minimize too many bills so that they find yourself with a budget that they cannot persist with.

Grades are decided by position title, e.g., a clerical position will get paid at a comparatively low pay grade in comparison with a senior management position. Every grade incorporates several wage rates, rising in increments from the underside to the highest. Each year on their anniversary dates, and primarily based on passable performance, employees get a wage enhance to the next step fee. When they reach the top step, they’ll proceed no further within a grade, except particular collective bargaining agreements provide in any other case. The price range for a fiscal 12 months which is handed by the Legislature and signed into law by the Governor.

Firms put together budgets and forecasts to predict their future wants. Often, these needs depend on growth trends, buyer demand, strategic plans, and so forth. For instance, they include price estimates, value classification, and budgeted costs. Subsequently, value budgeting might help set up whether companies must purchase finance to fund operations. The cost budgeting course of could differ from one firm to a different. Often, it entails managers getting ready a budget for his or her departments or features.

This means, you can pay yourself first, manage to pay for for the switch, and know you could meet your savings goal. If you are still not satisfied that budgeting is for you, this is a method to defend your self from your personal spending habits. Set up an computerized switch from your checking account to a financial savings account that you do not see frequently (i.e., at a different bank).

This is as a outcome of expenses similar to salaries and lease are normally fixed and cannot be easily adjusted in the brief time period. Corporations must carefully plan and manage their operating budgets to make sure they’ll cover their fastened costs. Income budgets, on the opposite hand, may be extra versatile as firms can discover new income streams or adjust pricing methods to increase income. Budgeted Income is the revenue degree projected in a monetary plan or budget. This figure represents the anticipated revenue expected to be earned by a business during a specific price range period.